A new dawn for Italian renewables

All eyes are on Italy, with the 10 GWh utility-scale battery auction results announced on Oct. 1, following the closure of the first FER X large-scale wind and solar auction on Sept. 12. Italian market veteran Massimo Poli, the Regional Manager for southern Europe at meteocontrol, outlines this latest phase of promising Italian-market development and how digital technologies will play a decisive role.

First arrived MACSE for battery energy storage and next will come the FER X for utility-scale solar and wind. Italy has entered a promising new period of utility-scale solar and storage development. Backed by ambitious deployment targets, a schedule of auctions look set to herald a new era of steady expansion and opportunities across the solar and storage supply chain.

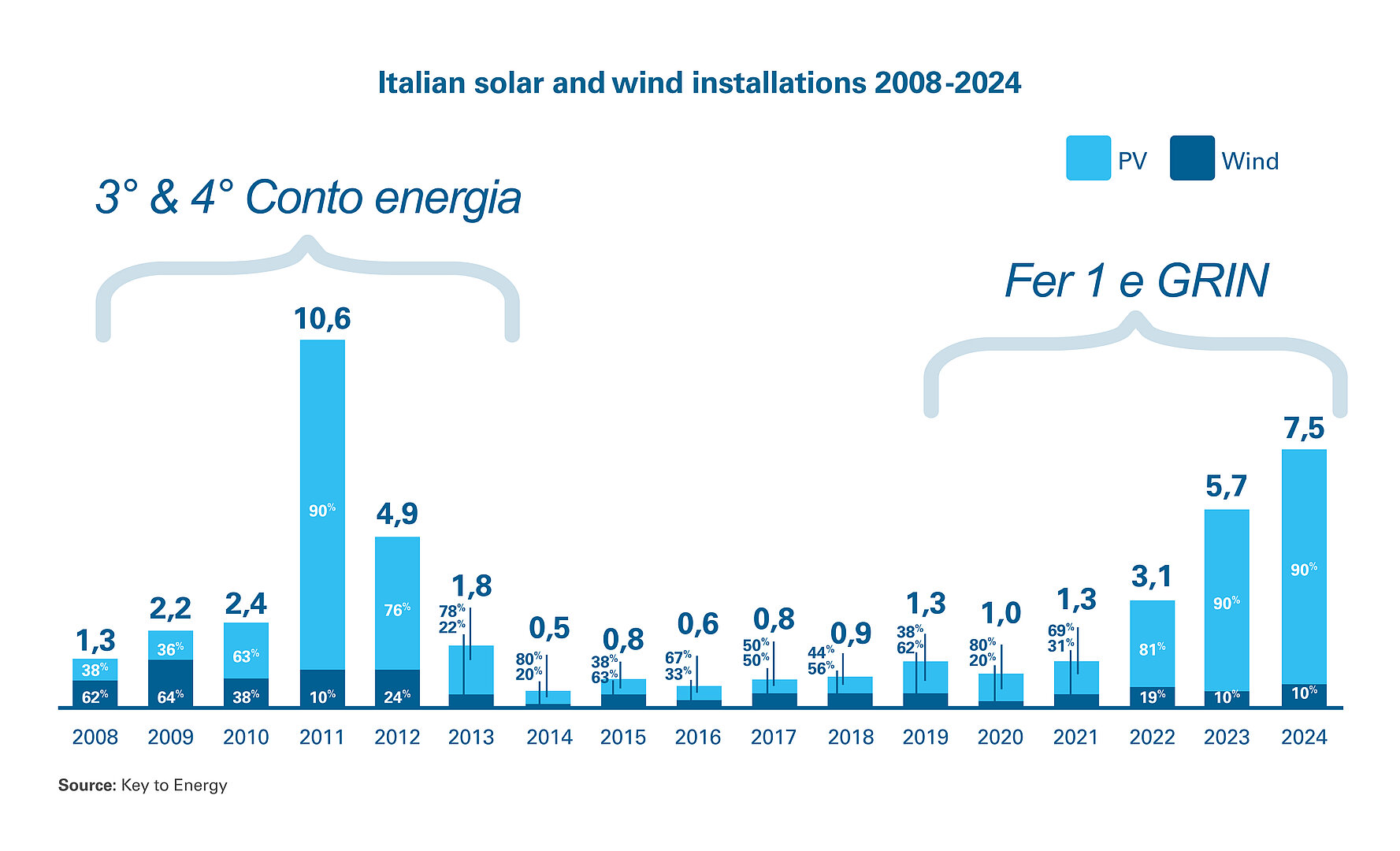

It is an exciting chapter for the Italian PV market, where consistent progress has been scarce over the past decade. Between 2011 and 2013, a short-lived boom driven by the fourth Conto Energia program led to 15.5 GW of solar installations, according to BloombergNEF. But once the program ended, annual installations crashed to less than 500 MW for the next five years.

While abrupt policy shifts have disrupted the Italian market in the past, today’s combination of government deployment targets and project auction programs for solar, wind, and batteries has Italy well-positioned for a period of strong and sustained growth starting in 2025.

However, the support programs and market dynamics are far from straightforward. Macroeconomic volatility, rigorous permitting procedures, and the challenges of integrating ever-growing renewable capacity into the electricity system all paint a complex picture. In this environment, experienced consultants play a vital role by helping market participants and investors navigate uncertainty, gain clarity, and craft effective business strategies.

For this article, I spoke with two such experts: Virginia Canazza, who recently joined Italian energy-market consultancy Key to Energy as a Partner, and Matteo Coriglioni, Head of Italy at European energy sector market intelligence company Aurora Energy Research. Drawing on my conversations with them, along with my two decades in renewable energy, I’ve synthesised some of the most impactful insights.

Investor interest is high

“The FER X auction will unlock a lot of capacity to be built,” Coriglioni told me, in the days leading up to the close of the first multi-gigawatt FER X auction. “There will be a massive amount of project financing, and the interest in the Italian market has increased a lot.”

This renewed interest stems from a mix of factors. After years of sluggish growth – held back by restrictive permitting processes, limited grid connections, and a lingering perception of high market risk – there is now significant pent-up demand.

“It is attractive to developers to be shielded from merchant exposure, as it increases project bankability,” explained Coriglioni. He noted that the FER X mechanism helps counteract solar price cannibalization – an increasingly common challenge in European electricity markets, where daytime prices often drop to zero or near-zero, sharply reducing solar capture rates.

Structured as a Contracts for Difference program, the FER X auction will result in a strike price at which projects are remunerated over a 20-year period. It also offers partial protection from inflation. “You are exposed to risk, but not entirely – and it makes your revenues more predictable,” Coriglioni added.

Strong (if not overwhelming) results

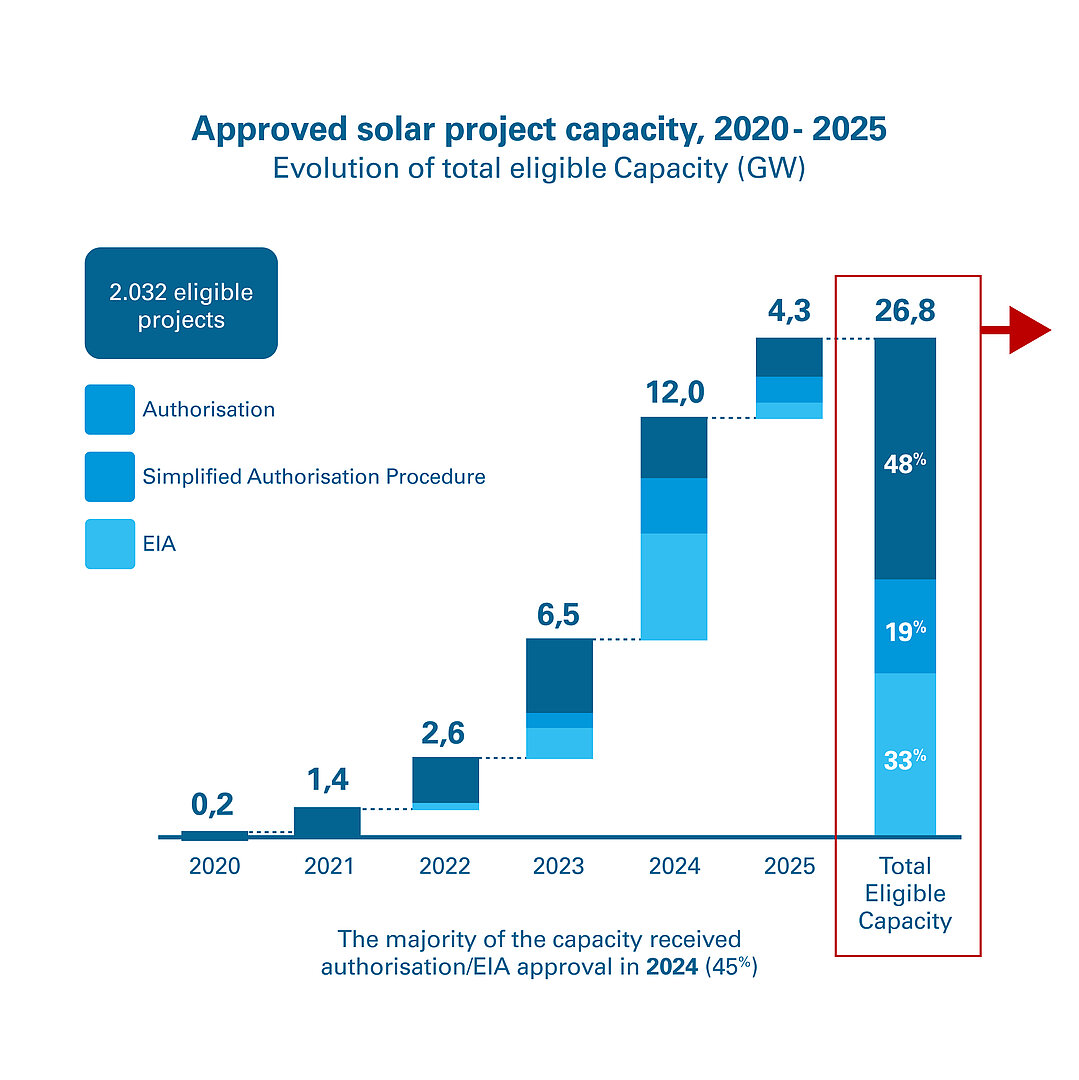

The FER X auction that closed in September targeted 8 GW of utility-scale solar and 2.5 GW of wind. In total, 818 solar project applications were submitted, representing just over 10 GW of capacity. While this oversubscription is encouraging, it falls short of being a runaway success. Wind results, in particular, were less impressive: only 52 projects applied, totaling around 1.7 GW –below the 2.5 GW of allocated capacity.

The volume of applications also stood out for being below the previously-registered expressions of interest. Nearly 1,400 PV projects, amounting to 17.5 GW of capacity, had initially signaled intent to participate in this round of the FER X. Still, fewer actual bids does not necessarily indicate that bid prices were not competitive, noted Key to Energy’s Canazza.

“Maybe the most expensive projects, looking for this level of competitiveness, decided to remain out of the auction and will opt for different structures – such as PPAs or maybe the next auction of FER X,” she said. Additionally, some project developers may have been deterred by the strong initial interest, anticipating cut-throat pricing and opting to sit this round out.

Ambitious targets

At the core of the FER X program are Italy’s ambitious renewable energy goals for 2030. In its National Energy and Climate Plan (NECP), the government announced a target of 79 GW of cumulative solar capacity by the end of the decade. To put this into perspective, Italy installed 4 GW of solar in 2023, according to BloombergNEF. Meeting the new target will require roughly 8 GW of annual PV installations, or about 9.5 GW when solar and wind are combined.

SolarPower Europe estimates that achieving this goal would attract €320 billion in investment and create 540,000 jobs. In collaboration with Italian industry associations ANIE Rinnovabili, Elettricità Futura, and Italia Solare, the industry association projected that around 57 GW of solar must be installed between 2024 and 2030 to align with the NECP. If achieved, solar would account for 68% of Italy’s renewable energy capacity.

“The government has set a very ambitious target for 2030,” said Canazza. “The policy strategy is emphasising the role of mature technologies – such as renewables and solar as the main source of energy transition towards an energy mix that is not based on fossil fuels.” The “centralised procedure,” namely the FER X, aims to accelerate solar and wind deployment and help the country “recover from past delays.”

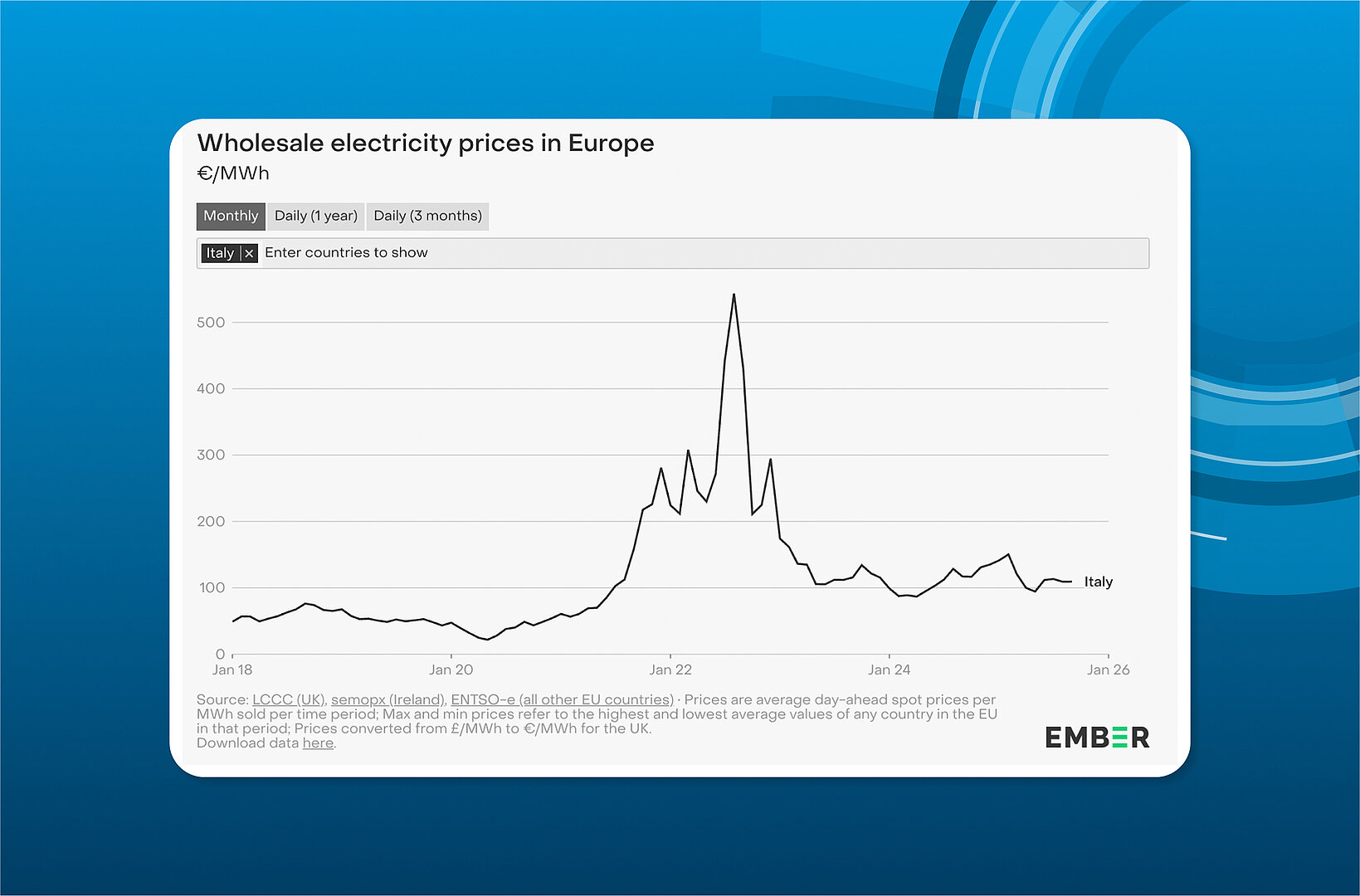

Still, Canazza noted that macroeconomic drivers are lacking in Italy, necessitating the government’s intervention. Electricity demand has not fully recovered from the shock of soaring gas prices following Russia’s full-scale invasion of Ukraine. Broader electrification of the economy is also lagging, with price volatility continuing to grow as renewable penetration increases.

On the flip side, Italy’s wholesale electricity prices remain relatively high. As tallied by independent energy think tank Ember, monthly averages have stayed near or above €100/MWh throughout 2025 – still elevated, but well below the astronomical peak of nearly €550/MWh in August 2022. Gas generation remains the marginal price setter and a cornerstone of supply, with rising gas and CO₂ costs adding further upward pressure. Ancillary service costs have also been a factor, although recent reforms by the transmission system operator Terna have begun to ease this burden.

Encouragingly, the 10 GW of applications in this latest FER X round signal a strong pipeline of utility-scale solar projects in development. With solar achieving record-low LCOEs across Europe, this new capacity is also expected to help deflate wholesale electricity prices.

Some developers appear to have delayed construction starts in order to participate in the CfD auctions, rather than face full market risk. However, if successful in the auctions, they will be required to complete projects within three years of the winners being announced. The results of this FER X round are expected in early 2026.

Drive for digitisation

While policy and regulation shape market development, technology remains a key pillar of the energy transition. High demand and inflation have disrupted many parts of the energy economy – gas turbines, for example, are facing delivery delays well into the next decade – yet solar equipment prices remain at historic lows. Meanwhile, Terna has deployed new digital and hardware solutions to reduce system costs and streamline renewable grid connections.

In its 5-year Industrial Plan approved in 2024, Terna announced a €17.7 billion investment program to make Italy’s electricity network more “efficient, digital, and resilient.” According to Canazza, this strategy has already helped reduce ancillary service costs. The initiatives include advanced grid sensors and monitoring, along with digital systems for renewable energy dispatch and control.

“Maximising the performance of the existing grid is an ongoing trend,” said Canazza. “Keep in mind, in the past ancillary service costs were very high.”

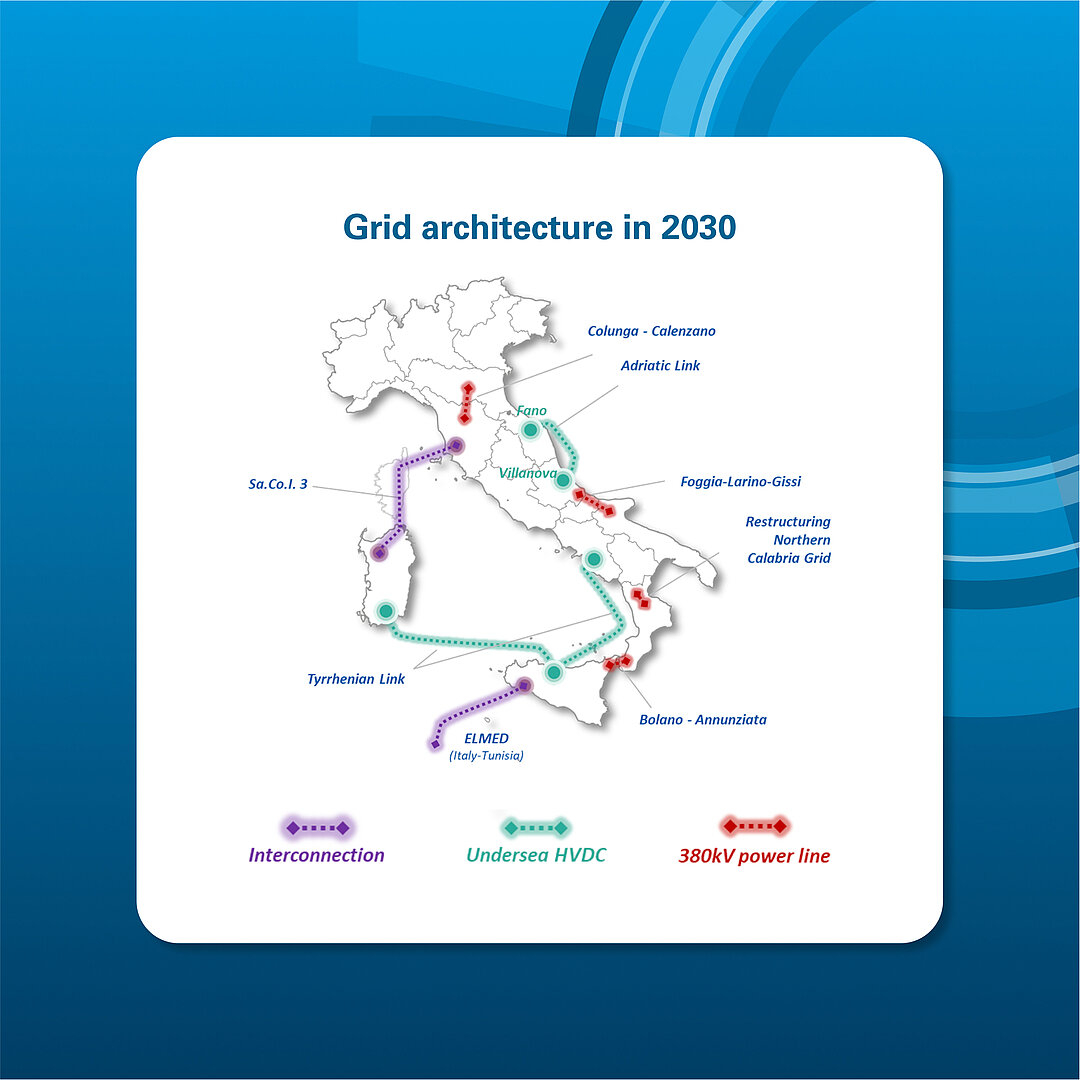

Alongside digitalisation, grid expansion is also underway. Terna this year unveiled a 10-year, €23 billion program of network investments. While timelines for such large-scale projects are often optimistic, the planned reinforcements – particularly new transmission capacity linking the renewable-rich south with the industrial north – will be critical to unlocking large volumes of solar and wind.

Permitting data underscores this regional imbalance. Key to Energy reports that of nearly 27 GW of solar projects advancing through authorisation, more than 16 GW are located in Sicily and the South, 4.7 GW in the Center South, and just 3.8 GW in the North. To address this, Terna has planned eight undersea and overland interconnection projects to be completed by 2030.

Terna’s digitisation efforts also create new challenges for solar developers. Under the FER X scheme, projects awarded contracts will be required to participate in the ancillary services market. Compliance with these new Terna requirements – which mandate the capability to ramp down or shut off generation – requires advanced monitoring, communication, and control systems. The CCI solution from meteocontrol, originally designed for high-voltage plantsand, following ARERA Resolution 385/2025/R/EEL of August 5, 2025, also for plants connected to the medium-voltage grid (≥100 kW), meets these requirements by ensuring compliance and responsiveness.

For solar plants, while curtailment will be compensated under the subsidy program, compliance requires advanced monitoring, communication, and control systems.

Batteries are coming

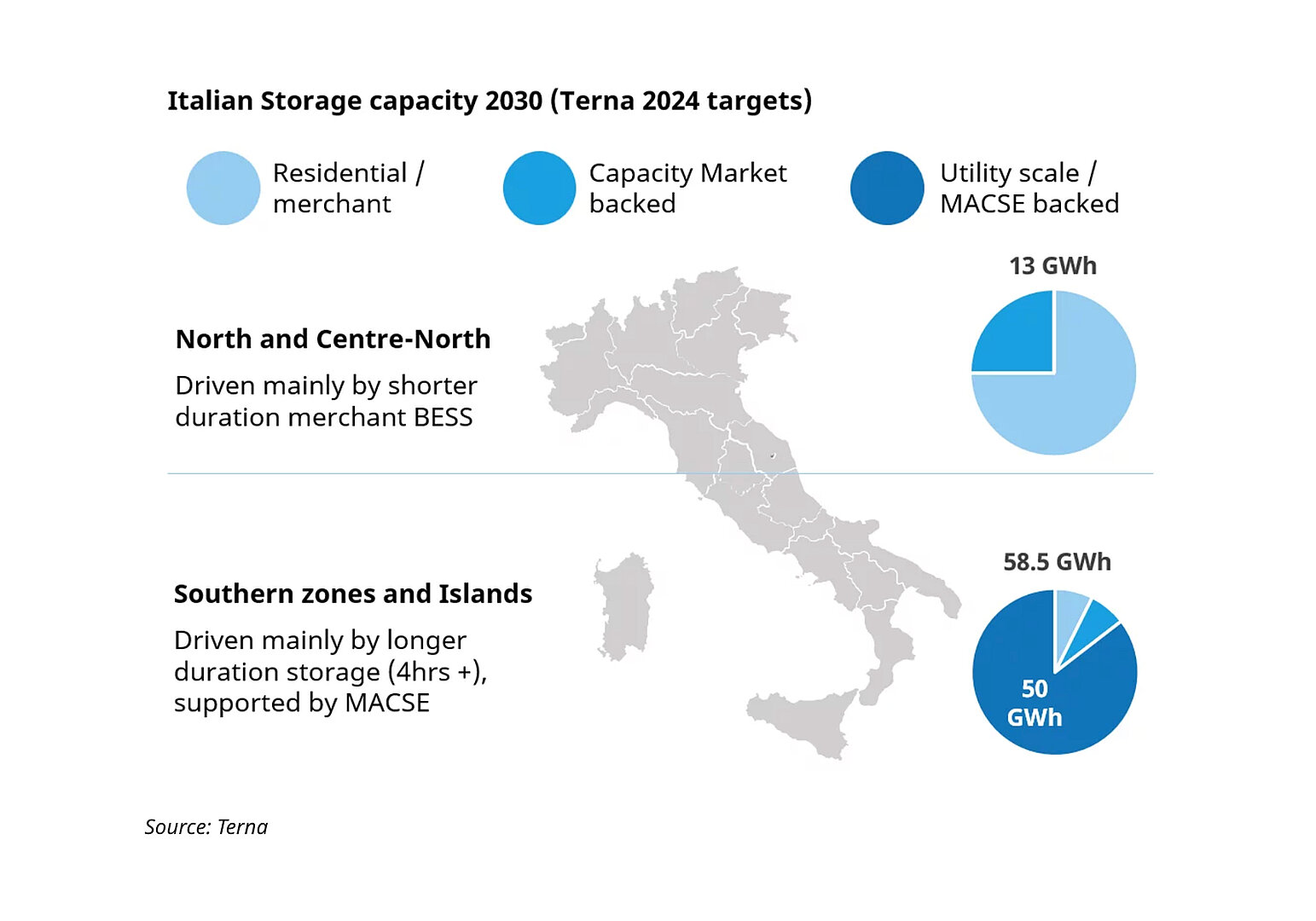

Complementing Terna’s grid-strengthening efforts is the rapid rollout of battery energy storage – and Italy’s ambitions here stand out among its European peers. In 2024, the country set an unprecedented target of 58 GWh of battery energy storage system (BESS) capacity by 2030, with a particular emphasis on the southern regions, where the majority of renewable energy projects will be developed.

“By 2030 there will be the highest amount of energy storage capacity in Europe and a lot of development activity going on,” said Aurora Energy Research’s Coriglioni.

The buildout will be driven by the Meccanismo di Approvvigionamento di Capacità di Stoccaggio Elettrico (MACSE) program. The winners of the first 10 GWh auction was announced on Oct. 1, and was four times oversubscribed. Terna reports that weighted average clearing prices of €12,959/MWh per year were achieved – well below the reserve premium of €37,000/MWh per year. A total BESS investment of over €1 billion is expected to be mobilised under the program. Though the contract structure is complex, it effectively de-risks BESS investment.

“The idea is the program divides the construction risk from the market risk,” explained Coriglioni. “It provides developers with a fixed contract meant to remunerate the capital deployment for the investment – but the financial benefits from operating the asset are not going to the asset owner but to third parties.” Terna will pool contracted storage capacity, from which time-shifting products can be created and sold to market participants.

For solar developers, the scale of BESS deployment under MACSE is welcome news. While storage won’t eliminate the problem of price cannibalisation, it will help soften its impact. As Coriglioni noted: “This storage capacity, rather than eliminating cannibalisation, is a key enabler to make sure that these solar assets can come online profitably, and without creating massive grid issues.”

Taken together, Italy’s solar and storage outlook is extremely promising. Multiple initiatives, evolving market dynamics, and new auctions are aligning to drive growth through the end of this decade – and likely into the 2030s. Risks remain, as past policy shifts have shown, but the imperative to relieve persistently high electricity prices is strong. And in the near term, development activity is set to accelerate.

“2026 will be one of the best years in terms of build out,” said Coriglioni. “The impact has been positive, and we are seeing positive developments.”

Massimo Poli

Massimo Poli was appointed the Regional Manager for the EU South region of Europe at meteocontrol in May 2025. He has more than two decades of international experience in the solar and renewable energy industry. Management positions at companies such as Jinko, Smartenergy, BKW, REC and Q Cells reflect his in-depth market knowledge and strategic expertise.