Marketing electricity without subsidies: When do Power Purchase Agreements make sense?

Renewable electricity has become so affordable that it can now be marketed outside of government tariff models. One such method is through Power Purchase Agreements (PPAs). Market trends suggest these contracts may play an increasingly important role. But in which cases are PPAs already the best marketing option? And how can developers of new installations and operators of post-EEG plants determine whether PPA-based electricity marketing is a viable option?

Let’s start with a definition: A PPA is a long-term electricity supply contract between a renewable energy producer (e.g., a wind or solar park) and a buyer—typically a corporation or utility company. The buyer agrees to purchase the generated electricity at a pre-determined price and for a set period (often 10 to 20 years). PPAs provide financial security to producers through guaranteed income and give buyers access to renewable energy, often at lower and more stable prices than the open market. The renewable power plants do not necessarily need to be located on the site where the energy is consumed.

Today’s PPA market

PPAs are not new—they’ve been around for decades. Originally, they were signed in the 1980s between conventional power plant operators and utility companies. In the 2000s, the US saw the first long-term PPAs for supplying large tech companies with renewable energy. In Europe, the UK, Spain, Scandinavia, Germany, and the Netherlands led the way during the 2010s. Australia’s PPA market also flourished during the last decade.

The RE-Source platform's European PPA Deal Tracker logs PPAs for wind and solar power in Europe. Spain currently leads Europe with 11.6 GW of contracted capacity, followed by Germany (6.9 GW) and Sweden (4.6 GW). Most electricity buyers are from the IT and heavy industry sectors. The largest PPA buyers in Europe include Amazon, Google, Microsoft, and the aluminum producer Alcoa.1 2 Between 2023 and 2024, the European market grew by 14%, with corporate PPAs being the fastest-growing segment3.

The German PPA market: unsubsidized solar parks and post-EEG plants

Germany’s PPA market comprises four distinct segments. The largest is new solar parks > 20 MW, which cannot be fully supported by market premiums. Any excess capacity beyond 20 MW must be marketed, often via PPAs.

The second key market is for renewable energy installations that have exited the 20-year EEG subsidy period. Germany also sees PPAs used for offshore wind parks and, temporarily, for EEG-supported systems switching to “other energy trading” to lock in prices.4

There is a growing share of unsubsidized solar parks in Germany. According to a pv magazine analysis in October 2024, about one-quarter of new PV capacity was unsubsidized, of which roughly 80% were ground-mounted systems.5 However, most solar parks in Germany are still funded through market premiums determined by EEG auctions.6

Germany’s 6.9 GW of PPAs make up only about 4% of the country’s total installed wind and solar capacity (166 GW).7 However, according to the Renewable Energies Market Initiative (Marktoffensive EE), PPAs could cover up to a quarter of electricity demand by 2030 – if the conditions develop favorably.

Are PPAs right for my project?

The answer is straightforward: Yes—if they provide the most lucrative electricity marketing option over the project’s lifetime. This depends on comparing potential revenues from various marketing options against the necessary expenses (electricity production costs).

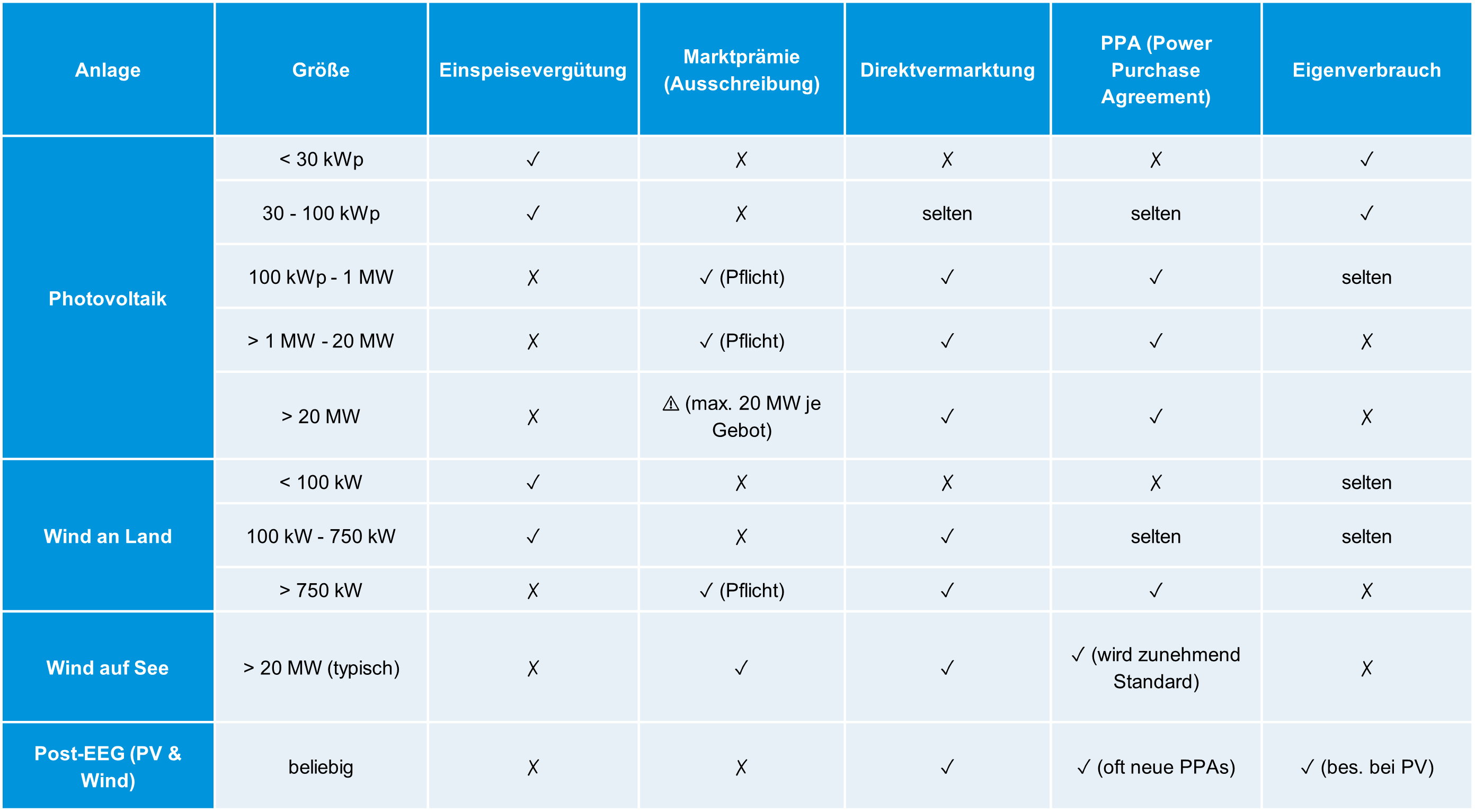

Marketing options and terms change regularly and differ by country. In Germany (meteocontrol's home market), the following options are available:

In Germany, PPAs are mostly used for solar parks >20 MW, new offshore wind projects, and post-EEG systems.

For post-EEG systems, PPAs generally become economically viable above 1 MW. For post-EEG systems between 100 kWp and 1 MW, energy trading is usually better due to its simplicity and availability of standard solutions on the market.

Large solar parks can choose between the market premium model (auctions) or Power Purchase Agreements. Major players with the required expertise can also sell directly on the spot market. Hybrid solutions can also be practical, such as PPA + self-consumption, market premium + residual power as PPA, or PPAs linked to exchange prices.

Implementing a PPA requires the appropriate expertise. For this, it is common to involve specialized consultants, law firms, and energy traders offering PPA services.

What sale price can PPAs yield?

Two common models are used to determine PPA prices in Germany:

The consumer-oriented model considers expected end-user electricity prices, guaranteed EEG feed-in tariffs, and the plant’s market value (including guarantees of origin). It is suitable for simpler PPAs with smaller buyers, where comparative values such as EEG or stock market prices serve as a guide.8 This makes it suitable for many post-EEG plants. Smaller customers are more willing to pay because they are more oriented toward end customer tariffs.

The second model is more closely aligned with the futures market and uses the baseload price. This is the average price that a plant can achieve on the market if it supplies electricity evenly, i.e., around the clock. A discount is applied for the generation profile (e.g., high at midday, none at night), marketing costs, and risk premiums; the value of the guarantees of origin is then added. 9 This method is used for more structured PPAs with professional buyers such as industrial firms or energy traders. Larger PPAs typically have lower price levels because the contracts are more structured, run for longer and are more complex.

The consulting firm Enervis publishes monthly PPA pricing in its PPA Price Tracker. This calculates baseload pricing for 10-year PV PPAs.10 The pricing determined in this way is represented in blue in the chart below. Compared to the average bid values from PV auctions, PPAs were more lucrative until July 2023. Since then, this has only been partially the case.11 If the revenues are compared with the range of electricity generation costs for solar parks in 2024 determined by the Fraunhofer Institute (3.1–5 ct./kWh) 12, it becomes apparent that not all solar park projects are economically viable under the current conditions.

In general, both the regulatory framework for government tariff models and market price developments are subject to constant change, which is why the period shown is only a snapshot. Consequently, a careful and up-to-date case-by-case assessment is always required in order to select the most lucrative model for electricity marketing at any given time.

In general, both the regulatory framework for government tariff models and market price developments are subject to constant change, which is why the period shown is only a snapshot. Consequently, a careful and up-to-date case-by-case assessment is always required in order to select the most lucrative model for electricity marketing at any given time.

The PPA market of tomorrow

PPAs compete with state tariff schemes. In its coalition agreement, the German federal government has committed to the long-term goal of making renewable energy fully market-financed. This implies a gradual phasing out of government tariff scheme and increased reliance on market-based mechanisms. At the same time, a secure investment framework with increased integration of market-based instruments must be established.13

A key factor for PPA viability is financing, which strongly depends on the creditworthiness of electricity buyers. This is why the EU’s 2024 Electricity Market Directive (EMD) calls on member states to explore and implement risk mitigation tools for PPAs. The goal is to help project developers access cheaper capital.14

Furthermore, climate policy initiatives such as the tightening of EU emissions trading are also strengthening the PPA market: Emission-intensive industries are incentivized to decarbonize their electricity supply via PPAs.15 However, new challenges – such as negative power prices, which have rarely been taken into account in traditional PPA models to date – require innovative contract solutions.16

Globally, PPAs are becoming increasingly important, both as as a tool for project financing and as a strategic lever for companies to decarbonize and hedge against price volatility.

In the USA, the demand for green electricity and new tax incentives under the Inflation Reduction Act are driving PPA growth.17 Large tech companies (Google, Meta, Amazon) rely on long-term contracts to manage market risks and meet ESG goals.18

In Latin America, Africa, and parts of Asia, PPAs often replace traditional subsidy mechanisms. They are essential for getting wind and solar projects off the ground in regions lacking feed-in tariffs.

PPAs are on the rise globally. Tomorrow’s PPA market will be driven by falling renewable generation costs, decarbonization goals, and the withdrawal of government subsidies. PPAs nonetheless enable project developers to achieve planning security, which also increases their independence from subsidy schemes. The success of the PPA market also depends on the exchange price of electricity and the creation of stable framework conditions.

1 PPA deal tracker (RE-Source Platform, 3/2025)

2 The European PPA-Market in 2024 (synertics)

3 Corporate PPAs treiben den Markt (pv magazine)

4 PPA-Marktanalyse Deutschland 2023 (DENA)

5 Bislang 1,36 Gigawatt Photovoltaik-Zubau für Oktober registriert (pv magazine)

6 Solarenergie in Deutschland boomt (DIW 2024)

7 Installierte Netto-Leistung zur Stromerzeugung in Deutschland in 2024 (Energy-Charts, 11/2024)

8 Power Purchase Agreement (node energy)

9 Power Purchase Agreements (next-kraftwerke.de)

10 PPA-Preistracker (pv magazine / enervis)

11 Ausschreibungsergebnisse (Bundesnetzagentur)

12 Studie: Stromgestehungskosten erneuerbare Energien (Fraunhofer ISE)

13 Koalitionsvertrag 21. Legislaturperiode (April 2025)

14 Risikoabsicherung für PPAs stärkt den Ausbau Erneuerbarer Energien (pv magazine)

15 Die PPA-Metamorphose: Deutschlands Energiemarkt im Wandel (Rödl & Partner)

16 Global Renewables Market Update | Q3 2024 (TRIO)

17 US clean power groups turn to longer deals to finance growth (Reuters)

18 BloombergNEF Corporate PPA Report (2024)